- February 17, 2014

- Posted by: Brian Poncelet

- Category: Approved, Life Insurance, World News Insurance

Hello 2014!

Sean Cooper wrote a blog (with my help) on Disability Insurance.

http://www.ratesupermarket.ca/blog/why-your-disability-coverage-may-not-be-enough/

Insure your paycheck

Make the most of disability insurance, an important and often misunderstood insurance.

https://www.fidelity.com/viewpoints/personal-finance/disability-insurance

“Disability coverage is one of the most ignored insurance coverages out there,” observes Keith Kruk, a Texas-based regional vice president of Fidelity Brokerage Services. “But the greatest asset we have isn’t our home or our car,” he says. “It’s our ability to wake up each morning, go to work, and get a paycheck.”

The important questions such as:

Why Do I Need Disability Insurance?

If you have a spouse and dependents, you should already have term life insurance to help protect your loved ones – but what if you become disabled and unable to earn a paycheque? Don’t think it can happen to you? Think again. One in three people will be disabled for 90 days or longer at least once before age 65.

Individual vs. Group Disability Insurance

“Many plans will only provide coverage for the first five years of your disability.

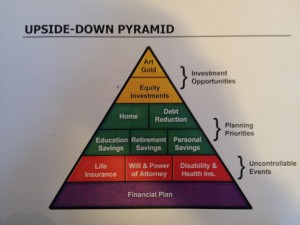

As you can see your disability coverage is vital to your financial plan.

In order to save on costs, many work policies have a two-year duration of benefits. If you become disabled, you’ll get paid for two years and then you’re on your own.

Who Needs Disability Insurance?

Unless you’re debt-free and can afford take a two-year vacation, you’ll most likely need some form of disability insurance. Unlike term life insurance, even individuals without a spouse or dependents need some form of disability coverage. Even an emergency fund with three months’ living expenses can quickly run dry if your disability is prolonged. Let’s take a look at the individuals who benefit most from individual disability coverage.